What is Real Estate Investing?

Real estate investing can be a lucrative way to build wealth . Real estate investors acquire, hold, and flip properties to make a profit . This guide explores what it means to be a real estate investor, including different types of real estate investments, strategies for success , and potential challenges.

Types of Real Estate Investments

1. Investing in Residential Properties

- Single-Family Homes: Homes intended for individual families. These are preferred among beginner investors due to their manageable investment size and simplicity in management .

- Multi-Family Properties: Buildings with multiple units, such as duplexes, triplexes, and apartment complexes. They generate more rent but demand greater management effort.

- Vacation Rentals: Houses rented on a short-term basis, usually through services like Airbnb. These can yield more profit but may have inconsistent occupancy and management needs .

2. Commercial Real Estate

- Office Buildings: Spaces leased to businesses for office use. They often have long-term leases , ensuring stable cash flow.

- Retail Properties: Commercial spaces occupied by retail outlets. Success is tied to the tenants’ business performance .

- Industrial Properties: Warehouses, manufacturing facilities, and distribution centers. These have long leases and require little oversight.

3. Investing in Industrial Properties

- Warehouses: Large storage spaces for goods and materials. Demand is fueled by online shopping expansion .

- Manufacturing Facilities: Properties where products are manufactured. These need expert understanding to invest .

- Distribution Centers: Facilities for distributing goods. High demand in supply chain management .

4. Investing in Land

- Undeveloped Land: Land that has not been improved or built upon. It offers potential for development but can be speculative .

- Developed Land: Property readied for building projects. Requires substantial funds and expert knowledge .

- Agricultural Land: Property used for agricultural purposes. Offers consistent profitability but requires farming expertise .

Strategies for Real Estate Investing

1. Buy and Hold

- Overview: Buy real estate to rent and keep for an extended period to gain from rent and value increase.

- Pros: Consistent rental income, tax advantages, and property value growth.

- Cons: Needs active management, locks in capital, subject to market fluctuations.

2. Fix and Flip

- Overview: Acquire, renovate, and quickly sell properties.

- Pros: High profit potential in a short period, property improvement.

- Cons: Significant risk, needs renovation expertise, reliant on market conditions.

3. Property Wholesaling

- Overview: Find discounted properties, secure them under contract, and assign the contract to another buyer for a fee.

- Pros: Requires little capital, fast deals, no property upkeep.

- Cons: Dependent on finding deals and buyers, smaller profits.

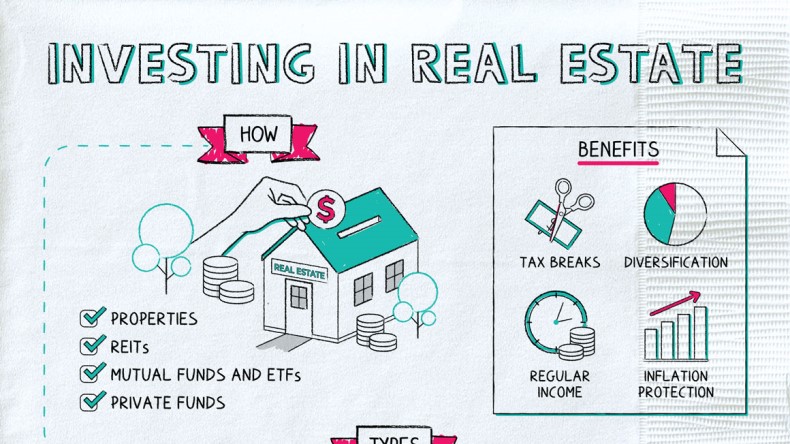

4. REITs (Real Estate Investment Trusts)

- Overview: Invest in firms owning and managing real estate assets.

- Pros: Liquidity, diversification, passive income, professional management.

- Cons: Market volatility, less control, wholesale realestate fees and expenses.

5. Real Estate Crowdfunding

- Overview: Invest collectively in real estate projects via crowdfunding sites.

- Pros: Small investment requirement, portfolio diversification, large project participation.

- Cons: Lack of direct control, associated fees, inherent risks.

Steps to Becoming a Real Estate Investor

Education and Research:

Learn the Basics: Understand real estate markets, financing options, property management, and investment strategies.

Networking: Engage with investment communities, participate in seminars, and network with seasoned investors.

Set Investment Goals:

Define Objectives: Set clear goals for your investments, whether for income, appreciation, or diversification.

Set Investment Goals

- Define Objectives: Clarify your investment aims, focusing on income, growth, or diversification.

- Risk Tolerance: Evaluate your risk tolerance to select suitable investment strategies.

Develop a Business Plan

- Market Analysis: Research target markets, property types, and potential investment returns.

- Financing Strategy: Prepare a financing plan using mortgages, private loans, and savings.

Build a Team

- Key Professionals: Gather a team of agents, lawyers, accountants, managers, and contractors.

- Networking: Maintain and grow your network of helpful professionals.

Start Small

- Initial Investment: Begin with smaller properties or simpler projects to gain experience.

- Learn and Adapt: Use early investments as learning experiences and refine your strategies.

Scale Up

- Growth: Gradually increase the size and complexity of your investments as you gain experience and confidence.

- Diversification: Diversify by adding different properties and locations to your portfolio.

Challenges and Risks in Real Estate Investing | Potential Challenges and Risks

1. Market Volatility

- Economic Factors: Real estate markets can be influenced by economic changes, interest rates, and government policies.

- Mitigation: Keep up with market trends and adapt your strategies.

2. Property Management

- Tenant Issues: Tenant problems, vacancies, and collecting rent can be difficult.

- Solutions: Hire a property management company or develop strong management skills.

3. Financing and Cash Flow

- Funding Challenges: Getting funding and managing cash flow can be challenging.

- Strategies: Have a solid financing plan and maintain a reserve fund for unexpected expenses.

4. Legal and Regulatory Issues

- Compliance: Make sure your investments adhere to legal requirements.

- Advice: Consult with legal professionals to navigate regulations and avoid pitfalls. step by step wholesaling real estate

Conclusion

Real estate investing can be highly rewarding to generate income and achieve financial freedom . By exploring different investment options, setting clear goals , and being prepared for challenges , you can succeed in real estate investing. Whether you are a beginner or an experienced investor , ongoing education and flexibility are key to achieving long-term success .